Use the following to answer questions

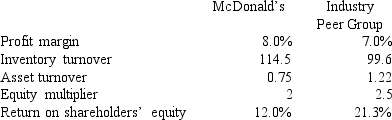

The following table presents a summary of ratio analysis for McDonald's and averages for their peer group:

-Are differences between McDonald's and the industry likely driven by differences in size between McDonald's and the average company in their industry peer group? Explain briefly.

Definitions:

Common Stock

A form of corporate equity ownership, a type of security representing ownership of a fraction of a company, providing voting rights and a share in the company’s profits.

Return on Investment

A performance measure used to evaluate the efficiency or profitability of an investment or compare the efficiency of a number of different investments.

Treasury Stock

Refers to shares that were issued and later reacquired by the company. It is subtracted from total equity.

Voting Rights

The rights of shareholders to vote on company matters, typically exercised during a corporation's annual general meeting.

Q20: Thompson's 2009 gross profit ratio is:<br>A)25%.<br>B)19%.<br>C)20%.<br>D)None of

Q25: Dowling's return on equity for 2009 is:<br>A)22%.<br>B)24.3%.<br>C)17.4%.<br>D)9%.ROE

Q46: Raintree Corporation maintains its records on

Q63: The primary professional organization for those accountants

Q66: Rent collected in advance is:<br>A)An asset account

Q81: The gross profit ratio is calculated by

Q86: An investor purchases a 20-year, $1,000 par

Q89: In its December 31, 2009, balance sheet,

Q102: On June 14, 2009, Rumsfeld Company sold

Q105: When an employer makes an end-of-period adjusting