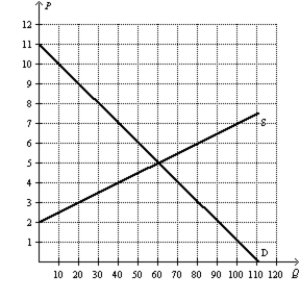

Figure 8-22

-Refer to Figure 8-22.Suppose the government changed the per-unit tax on this good from $3.00 to $1.50.Compared to the original tax rate,this lower tax rate would

Definitions:

Ending Inventory

The value of goods that a company has in stock at the end of its fiscal year, calculated as the beginning inventory plus purchases minus the cost of goods sold.

Accounts Payable

A liability to a creditor, carried on an open account, usually for purchases of goods and services.

LIFO Retail Inventory Method

An accounting technique that values inventory on the assumption that the last items placed in inventory are sold first, specifically applied to retail settings.

Ending Inventory

The value of goods available for sale at the end of an accounting period, calculated by adding purchases to beginning inventory and subtracting cost of goods sold.

Q26: Assume,for Japan,that the domestic price of automobiles

Q45: Refer to Figure 7-22.If 40 units of

Q49: Refer to Figure 8-10.Suppose the government imposes

Q86: Economists typically measure efficiency using<br>A)the price paid

Q95: Efficiency in a market is achieved when<br>A)a

Q173: Refer to Figure 9-4.With trade,Nicaragua<br>A)imports 150 calculators.<br>B)imports

Q179: Refer to Figure 8-1.Suppose the government imposes

Q188: Refer to Figure 8-9.The per-unit burden of

Q229: When a tax is placed on a

Q283: Refer to Figure 9-2.With free trade,consumer surplus