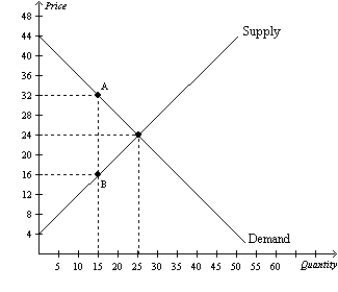

Figure 8-7

The vertical distance between points A and B represents a tax in the market.

-Refer to Figure 8-7.As a result of the tax,

Definitions:

Equity Method

An accounting technique used when a company has significant influence over another company it invests in, typically reflected by owning 20% to 50% of the voting stock, where the investment is initially recorded at cost and adjusted thereafter for the post-acquisition change in the investor’s share of the investee’s net assets.

Reported Loss

Financial results showing that a company's expenses exceeded its revenues during a specific period, leading to a negative net income.

Internal Accounting Records

A collection of documents and ledgers used by a business to track financial transactions, assets, liabilities, and equity.

Equity Method

An approach to account for equity investments by adjusting the investment's value to mirror changes in the investee's net assets.

Q3: Refer to Figure 7-16.If the price of

Q12: Economists disagree on whether labor taxes cause

Q47: Taxes cause deadweight losses because taxes<br>A)reduce the

Q57: If the tax on gasoline increases from

Q62: Producer surplus directly measures<br>A)the well-being of society

Q110: Refer to Figure 7-24.If 6 units of

Q111: Refer to Figure 8-12.Suppose a $3 per-unit

Q162: Suppose a tax of $3 per unit

Q168: Refer to Figure 8-7.As a result of

Q294: Refer to Figure 9-24.Suppose the government imposes