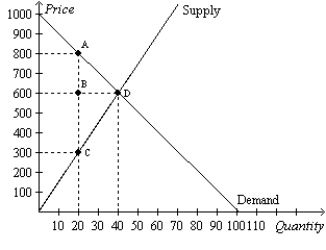

Figure 8-9

The vertical distance between points A and C represents a tax in the market.

-Refer to Figure 8-9.The imposition of the tax causes the price received by sellers to

Definitions:

Cash Budgeting

The process of planning and managing a company's cash inflows and outflows over a specific period of time, predicting its future cash position.

Carrying Costs

The expenses associated with holding inventory, including storage, insurance, taxes, and opportunity costs, which can affect a company's profitability.

Shortage Costs

Costs incurred when the demand for a product or service exceeds the supply, leading to potential loss of sales or customer dissatisfaction.

Restrictive Policy

A policy designed to limit or restrict certain actions, often used to control spending or investments.

Q17: The amount of deadweight loss from a

Q39: If the government levies a $500 tax

Q47: Suppose sellers of perfume are required to

Q48: Producer surplus equals<br>A)Value to buyers - Amount

Q79: When there is a technological advance in

Q82: If the United States changed its laws

Q109: Refer to Figure 8-8.The tax causes consumer

Q183: Refer to Figure 6-24.Which of the following

Q199: Refer to figure 9-26.After opening the U.S.baseball

Q273: Refer to Figure 9-22.Suppose the government imposes