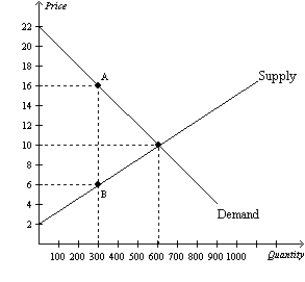

Figure 8-6

The vertical distance between points A and B represents a tax in the market.

-Refer to Figure 8-6.When the tax is imposed in this market,buyers effectively pay what amount of the $10 tax?

Definitions:

Net Income

The residual profits a company holds after deducting expenses, taxes, and costs from the gross income.

Stockholders' Equity

The residual interest in the assets of an entity that remains after deducting its liabilities; also known as shareholders' equity.

Deferral

In accounting, the postponement of recognition of an expense or revenue that has been incurred or earned to a later accounting period.

Interest Payable

This is the amount of interest expense that has been incurred by a company but not yet paid to creditors.

Q16: Which of the following will cause a

Q17: Refer to Figure 8-1.Suppose the government imposes

Q20: Brock is willing to pay $400 for

Q21: Refer to Figure 7-9.If producer surplus is

Q22: Refer to Figure 7-27.Sellers whose costs are

Q25: Refer to Figure 7-8.At the equilibrium price,consumer

Q31: Refer to Scenario 8-1.Assume Erin is required

Q33: In which of the following instances would

Q64: Refer to Figure 7-16.Suppose the price of

Q173: Refer to Figure 8-6.Without a tax,total surplus