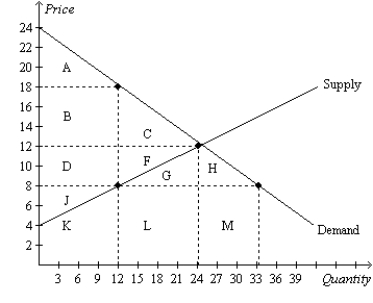

Figure 8-8

Suppose the government imposes a $10 per unit tax on a good.

-Refer to Figure 8-8.The tax causes producer surplus to decrease by the area

Definitions:

Retroactive Effect

The Retroactive Effect refers to changes that are applied to past periods or actions, such as changes in accounting policies that affect previous financial statements.

Straight-Line Depreciation

A method of allocating the cost of a tangible asset over its useful life in equal annual amounts.

Estimated Useful Life

The expected time period during which an asset is useful to the owner and can contribute to revenue generation.

Revised Estimated

An updated projection or forecast, usually pertaining to budgeted or financial figures, based on new information or analyses since the original estimate was made.

Q1: How is the burden of a tax

Q9: Suppose a tax of $1 per unit

Q11: Refer to Figure 7-4.Which area represents the

Q12: The principle of comparative advantage asserts that<br>A)not

Q15: Refer to Figure 8-11.The length of the

Q30: The market for soybeans in Canada consists

Q102: Some time ago,the nation of Republica opened

Q105: Refer to Figure 7-25.Suppose the government imposes

Q105: A $0.10 tax levied on the sellers

Q218: Refer to Figure 9-14.A result of this