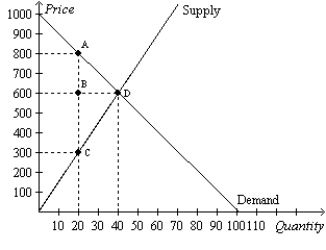

Figure 8-9

The vertical distance between points A and C represents a tax in the market.

-Refer to Figure 8-9.The imposition of the tax causes the price received by sellers to decrease by

Definitions:

Discount Period

The timeframe during which a payment can be made at a reduced price or with a deduction from the full invoice amount.

Sales Discounts

A reduction in the sale price offered by a seller to a buyer for prompt payment or within a specific time period.

Accounts Receivable

Customers' financial commitments to a firm for goods or services taken, pending reimbursement.

Perpetual Inventory System

A method of accounting that instantly records inventory sales or purchases using computerized point-of-sale systems and enterprise asset management software.

Q4: Taxes on labor encourage which of the

Q5: Assume that for good X the supply

Q14: Donald produces nails at a cost of

Q14: Refer to Figure 6-19.Suppose a tax of

Q22: Producer surplus is<br>A)represented on a graph by

Q46: Refer to Figure 8-15.Panel (a)and Panel (b)each

Q91: Refer to Figure 7-21.When the price is

Q166: Which of the following is not correct?<br>A)Taxes

Q214: Suppose a tax of $5 per unit

Q247: Some goods can be produced at low