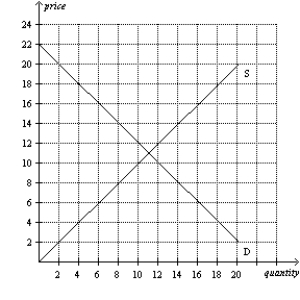

Figure 6-10

-Refer to Figure 6-10.A price ceiling set at

Definitions:

Delta

In finance, it represents the ratio that compares the change in the price of an asset, usually a marketable security, to the corresponding change in the price of its derivative.

Gamma

A measure of the rate of change in an option's delta for a one-unit change in the price of the underlying asset.

Theta

In financial markets, it represents the rate of decline in the value of an option as time to expiration decreases, holding all else constant.

Black-Scholes

It's a mathematical model used for pricing European-style options, taking into account factors like volatility, underlying asset price, and time to expiration.

Q42: Abraham drinks Mountain Dew.He can buy as

Q58: A binding price floor will reduce a

Q64: Suppose that two supply curves pass through

Q67: Consider the market for gasoline.Buyers<br>A)and sellers would

Q164: The quantity sold in a market will

Q175: Refer to Figure 6-9.At which price would

Q179: The minimum wage has its greatest impact

Q226: Refer to Figure 5-3.Which demand curve is

Q235: The price elasticity of demand for bread<br>A)is

Q278: Suppose there is a 6 percent increase