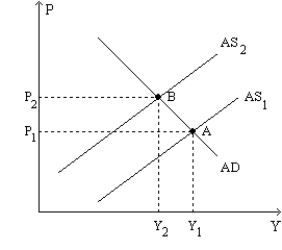

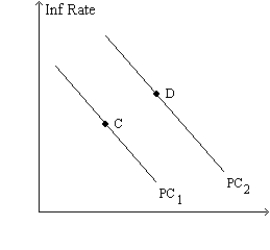

Figure 35-9.The left-hand graph shows a short-run aggregate-supply (SRAS) curve and two aggregate-demand (AD) curves.On the right-hand diagram,"Inf Rate" means "Inflation Rate."

-Refer to Figure 35-9.Which of the following events could explain the shift of the aggregate-supply curve from AS1 to AS2?

Definitions:

Taxpayer's Spouse

The legally married partner of an individual, whose financial information may be included or considered in joint tax filings.

Premium Tax Credit

A refundable tax credit for eligible individuals and families who purchase health insurance through the marketplace.

Credit Calculation

The process of determining the amount of credit that can be claimed by an individual or entity, often related to tax credits or financial rebates.

Rental Property

Rental property refers to real estate owned by an individual or entity that is leased or rented out to tenants in exchange for monthly rent payments.

Q2: The two words most often used by

Q16: Some economists believe that there are positives

Q18: There is an adverse supply shock.In response

Q21: Refer to Monetary Policy in Flosserland.Suppose that

Q21: Suppose that the MPC is 0.7,there is

Q26: A country has a growth rate of

Q26: The Federal Reserve<br>A)requires little time to change

Q42: According to the Phillips curve,policymakers could reduce

Q43: Means-tested college aid,base college aid primarily on<br>A)a

Q48: Which of the following shifts aggregate supply