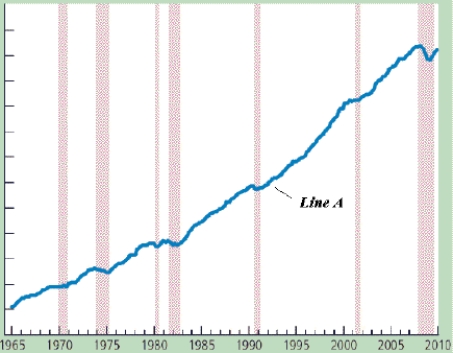

Figure 33-1.

-Refer to Figure 33-1.Line A is

Definitions:

Schedule C

A form used by sole proprietors to report their business income and expenses to the IRS as part of their personal tax return.

Form 1040

The standard IRS form that individuals use to file their annual income tax returns, encompassing income, deductions, and credits.

§179 Expense Deduction

The §179 expense deduction allows businesses to deduct the full purchase price of qualifying equipment or software purchased or financed during the tax year, subject to certain limits.

Earned Income

Income derived from active participation in a business or wage-earning employment.

Q9: If the demand for net exports rises,which

Q30: According to purchasing-power parity,if the price of

Q34: The average price level is measured by<br>A)the

Q38: When taxes decrease,consumption<br>A)decreases as shown by a

Q47: If speculators lost confidence in foreign economies

Q60: Suppose a Starbucks tall latte costs $4.00

Q71: From 1970 to 1998 the U.S.dollar<br>A)gained value

Q95: A country has output of $900 billion,consumption

Q103: In an open economy,the demand for loanable

Q123: A firm produces construction equipment,some of which