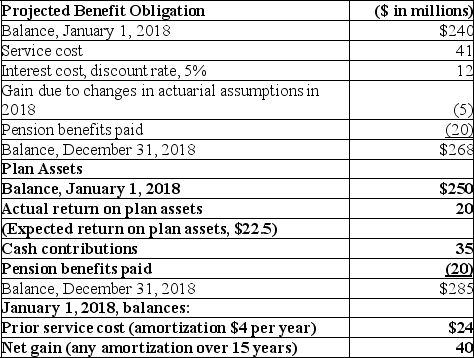

Orpheum Productions has a noncontributory, defined benefit pension plan. On December 31, 2018 (the end of Orpheum's fiscal year), the following pension-related data were available:  Required:

Required:

1) Prepare the 2018 journal entry to record pension expense.

2) Prepare the 2018 journal entry to record the contribution to plan assets.

3) Prepare the journal entries to record any 2018 gains and losses.

Definitions:

Q25: Theodore Enterprises had the following pretax

Q83: Discount rate<br>A)Risk borne by employee.<br>B)Return on plan

Q94: Cumulative<br>A)May be increased when net income increases.<br>B)A

Q122: Operating loss carryforward<br>A)Is usually a revenue or

Q169: The valuation allowance account that is used

Q174: If a company's deferred tax asset is

Q199: Which of the following is not among

Q209: <br>Which of the above constitutes the projected

Q217: A disclosure note from E Corp.'s 2018

Q234: What is Havana's 2018 actual return on