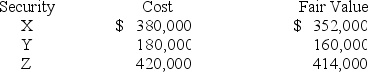

Hobson Company bought the securities listed below during 2017. These securities were classified as trading securities. In its December 31, 2017, income statement Hobson reported a net unrealized holding loss of $13,000 on these securities. Pertinent data at the end of June, 2018 is as follows:  What amount of unrealized holding loss on these securities should Hobson include in its income statement for the six months ended June 30, 2018?

What amount of unrealized holding loss on these securities should Hobson include in its income statement for the six months ended June 30, 2018?

Definitions:

Disregard

To pay no attention or too little attention to; to ignore or overlook intentionally.

Down Payment

A portion of the purchase price paid to the seller at the time of sale.

Deposit

Money given in advance as security or part payment, indicating commitment to a purchase or agreement and may be refundable under specific conditions.

Specific Performance

A judicial remedy requiring a party to fulfill their obligations under a contract, typically used when monetary damages are inadequate.

Q7: Synthetic Fuels Corporation prepares its financial statements

Q15: Average accumulated expenditures for 2019 was:<br>A) $536,000.<br>B)

Q26: Bonds are issued on June 1, 2018

Q100: Maltese is a privately-owned company. On September

Q103: Bonds that are purchased with the intent

Q107: Interest expense is:<br>A) The effective interest rate

Q116: Short-term obligations can be reported as long-term

Q117: On January 1, 2018, Nana Company paid

Q118: Assume that Nichols concludes that the

Q118: Vijay Inc. purchased a three-acre tract of