Cold Cat Inc., a snowmobile manufacturer, reported the following in its 20X5 annual report to shareholders:

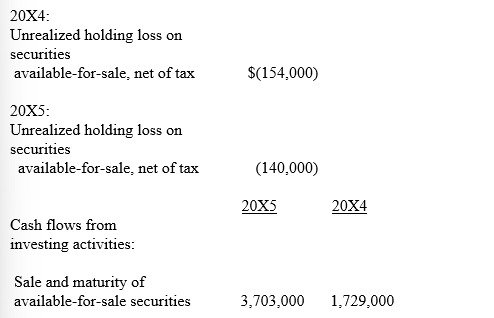

Trading securities consist of $54,608,000 and $41,707,000 invested in various corporate bonds at March 31, 20X5 and 20X4, respectively, while the remainder of trading securities and available-for-sale securities consist primarily of A-rated or higher municipal bond investments. The amortized cost and fair value of debt securities classified as available-for-sale was $3,105,000 and $3,196,000, at March 31, 20X5. The unrealized holding gain on available-for-sale debt securities is reported, net of tax, as a separate component of shareholders' equity.

Cold Cat Inc.

CONSOLIDATED STATEMENTS OF SHAREHOLDERS' EQUITY

Years Ended March 31,

Accumulated Other Comprehensive Income changed by the following amounts:

NOTE B - SHORT-TERM INVESTMENTS

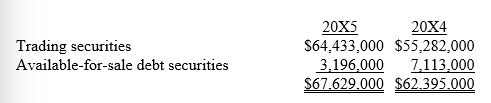

Short-term investments consist primarily of a diversified portfolio of municipal and corporate bonds and are classified as follows at March 31:

In its 20X4 annual report, Cold Cat disclosed, "The contractual maturities of available-for-sale debt securities at March 31, 20X4, are $3,573,000 within one year and $3,340,000 from one year through five years."

-Assume Cold Cat did not purchase any trading securities during 20X5. Prepare a journal entry to record any unrealized holding gains or losses on trading securities during 20X5.

Definitions:

MRTS

Marginal Rate of Technical Substitution, the rate at which one factor must decrease as another increases to keep output constant.

Isoquant Map

An isoquant map is a graph showing combinations of inputs that yield the same level of output, used in economics to depict production efficiencies and substitutability between inputs.

Printing Presses

Machines used for transferring text and images onto paper or similar materials, pivotal in the history of publishing and information dissemination.

Marginal Rate

A term that often refers to the marginal rate of substitution in economics, which measures the rate at which a consumer can give up some amount of one good in exchange for another good while maintaining the same level of utility.

Q5: For a loss contingency to be accrued,

Q24: Additions<br>A)Cost allocation for an intangible asset.<br>B)Adding a

Q42: On March 1, 2018, E Corp. issued

Q73: Changes in the estimates involved in depreciation,

Q74: The basic principle used to value an

Q74: According to International Financial Reporting Standards (IFRS),

Q78: Jennings Advertising Inc. reported the following

Q80: Unrealized holding gains and losses on securities

Q108: Required:<br>Compute depreciation for 2018 and 2019 and

Q118: Vijay Inc. purchased a three-acre tract of