Cold Cat Inc., a snowmobile manufacturer, reported the following in its 20X5 annual report to shareholders:

Trading securities consist of $54,608,000 and $41,707,000 invested in various corporate bonds at March 31, 20X5 and 20X4, respectively, while the remainder of trading securities and available-for-sale securities consist primarily of A-rated or higher municipal bond investments. The amortized cost and fair value of debt securities classified as available-for-sale was $3,105,000 and $3,196,000, at March 31, 20X5. The unrealized holding gain on available-for-sale debt securities is reported, net of tax, as a separate component of shareholders' equity.

Cold Cat Inc.

CONSOLIDATED STATEMENTS OF SHAREHOLDERS' EQUITY

Years Ended March 31,

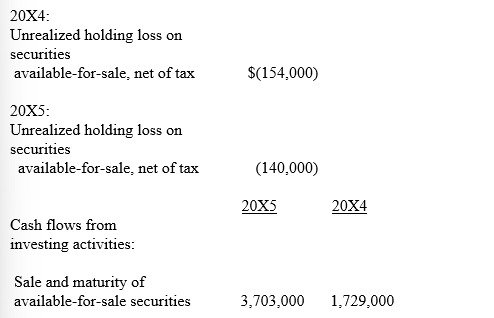

Accumulated Other Comprehensive Income changed by the following amounts:

NOTE B - SHORT-TERM INVESTMENTS

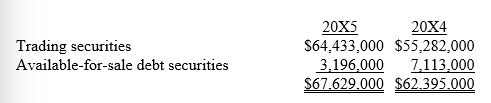

Short-term investments consist primarily of a diversified portfolio of municipal and corporate bonds and are classified as follows at March 31:

In its 20X4 annual report, Cold Cat disclosed, "The contractual maturities of available-for-sale debt securities at March 31, 20X4, are $3,573,000 within one year and $3,340,000 from one year through five years."

-How much did Cold Cat actually receive from the sale of available-for-sale securities during 20X5?

Definitions:

Tax Revenues

The proceeds that governments secure by enacting taxes.

Tax

A financial charge or levy imposed by a government on individuals or entities, primarily used to fund public expenditures.

Deadweight Loss

Economic inefficiency created by a divergence from the optimal market equilibrium, often caused by taxes, subsidies, or other market interventions.

Beer

An alcoholic beverage made from the fermentation of cereal grains, primarily barley, with hop additions for flavor.

Q5: For a loss contingency to be accrued,

Q22: Which of the following types of subsequent

Q36: Qualcomm Inc. engages in the development, design,

Q38: Under the LIFO retail method, the current

Q54: International Financial Reporting Standards allow the reversal

Q64: A company that prepares its financial statements

Q79: Many corporations own more than 50% of

Q82: Interest capitalized for 2019 was:<br>A) $104,625.<br>B)

Q157: On July 1, 2018, Flay Foods issued

Q168: Discount on bonds<br>A)Market rate higher than stated