Cold Cat Inc., a snowmobile manufacturer, reported the following in its 20X5 annual report to shareholders:

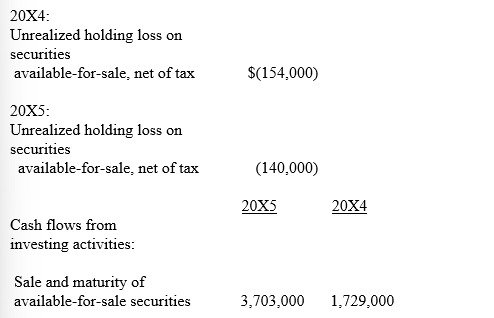

Trading securities consist of $54,608,000 and $41,707,000 invested in various corporate bonds at March 31, 20X5 and 20X4, respectively, while the remainder of trading securities and available-for-sale securities consist primarily of A-rated or higher municipal bond investments. The amortized cost and fair value of debt securities classified as available-for-sale was $3,105,000 and $3,196,000, at March 31, 20X5. The unrealized holding gain on available-for-sale debt securities is reported, net of tax, as a separate component of shareholders' equity.

Cold Cat Inc.

CONSOLIDATED STATEMENTS OF SHAREHOLDERS' EQUITY

Years Ended March 31,

Accumulated Other Comprehensive Income changed by the following amounts:

NOTE B - SHORT-TERM INVESTMENTS

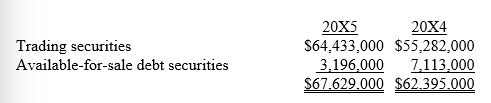

Short-term investments consist primarily of a diversified portfolio of municipal and corporate bonds and are classified as follows at March 31:

In its 20X4 annual report, Cold Cat disclosed, "The contractual maturities of available-for-sale debt securities at March 31, 20X4, are $3,573,000 within one year and $3,340,000 from one year through five years."

-What gain or loss would be realized if the available for sale securities on Cold Cat's 3/31/X5 balance sheet were sold immediately for their fair value? Prepare any reclassification entry and an entry that would record the sale (ignore taxes).

Definitions:

Degrees of Competition

The extent to which market competition exists, characterized by the number of firms, product differentiation, and barriers to entry.

Pure Monopoly

A market structure where a single seller controls all of a product's supply and can set prices without competition.

Pure Competition

A market structure characterized by a large number of small firms, a homogeneous product, and easy entry and exit, leading to perfect competitive markets.

Differentiated Oligopoly

A market structure where a few firms dominate, but differentiate their products through branding, quality, or other means to compete.

Q16: Using the sum-of-the-years'-digits method, depreciation for

Q25: Which of the following would not require

Q37: Which of the following typically refers to

Q44: Unlike the Social Security tax there is

Q45: Identify and define the three classifications prescribed

Q111: On July 1, 2018, Clearwater Inc.

Q111: Nanki Corporation purchased equipment on January 1,

Q122: The following selected transactions relate to contingencies

Q127: Crawford Inc. has bonds outstanding during a

Q198: On January 1, 2013, F Corp. issued