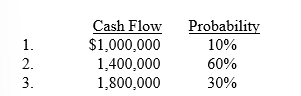

Calegari Mining paid $2 million to obtain the rights to operate a coal mine in Tennessee. Costs of exploring for the coal deposit totaled $1,500,000, and development costs of $5 million were incurred in preparing the mine for extraction, which began on January 2, 2018. After the coal is extracted in approximately five years, Calegari is obligated to restore the land to its original condition. The company's controller has provided the following three cash flow possibilities for the restoration costs:

The company's credit-adjusted, risk-free rate of interest is 7%, and its fiscal year ends on December 31.

Required:

1. What is the initial cost of the coal mine? (Round computations to nearest whole dollar.)

2. How much accretion expense will Calegari report in its 2018 and 2019 income statements?

3. What is the book value of the asset retirement obligation that Calegari will report in its 2018 and 2019 balance sheets?

4. Assume that actual restoration costs incurred in 2023 totaled $1,370,000. What amount of gain or loss will Calegari recognize on retirement of the liability?

Definitions:

Operating Activities

Activities that relate to the primary operations of a company, including production, sales, and delivery of its products or services.

Income Statement

A document detailing a corporation's financial results for a given fiscal period, including income, costs, and net profit.

Balance Sheet

A financial statement that shows a company's assets, liabilities, and shareholders' equity at a specific point in time, providing a basis for computing rates of return and evaluating capital structure.

Financing Activities

Transactions between a business and its sources of funding, including equity and debt, reflected in the cash flow statement.

Q4: Rearrangements<br>A)Considered if indicated that book value may

Q24: Calistoga's final balance in its allowance

Q35: In applying LCM, market cannot be:<br>A) Less

Q35: Briefly explain the differences between U.S. GAAP

Q72: The receivables turnover ratio provides a way

Q103: The initial cost of property, plant, and

Q140: Cash equivalents do not include:<br>A) Money market

Q140: During 2018, WW Inc. reduced its LIFO

Q140: Required:<br>Compute depreciation for 2018 and 2019 and

Q210: Property, plant, and equipment and finite-life intangible