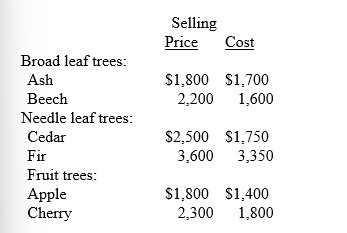

Novelli's Nursery has developed the following data in order to calculate the lower of cost or net realizable value for its products. The individual products are listed within the categories of trees.

The costs to sell are 10% of selling price.

-Required: Determine the reported inventory value assuming the lower of cost or net realizable value rule is applied to the total inventory.

Definitions:

Conversion Cost

The combination of direct labor and manufacturing overhead costs incurred to transform materials into finished goods.

Manufacturing Overhead Cost

The indirect factory-related costs that are incurred when a product is manufactured, including costs related to maintaining the factory.

Conversion Cost

The sum of direct labor costs and manufacturing overhead expenses involved in converting raw materials to finished products.

Total Variable Cost

The sum of all variable expenses that change in proportion with production output or business activity levels.

Q1: Dollar-value LIFO:<br>A) Starts with ending inventory measured

Q9: Double-declining balance<br>A)Cost allocation for an intangible asset.<br>B)Adding

Q55: What was the final cost of

Q76: The average days inventory for ATC (rounded)

Q82: Interest capitalized for 2019 was:<br>A) $104,625.<br>B)

Q91: FIFO periodic and FIFO perpetual always produce

Q103: Although the net method is theoretically more

Q130: In a bank reconciliation, adjustments to the

Q144: As of January 1, 2018, Farley Co.

Q215: In the first year of an asset's