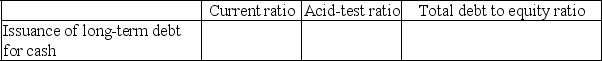

Indicate whether each of the actions listed below will immediately increase (I), decrease (D), or have no effect (N) on the ratios shown. Assume each ratio is greater than 1.0 before the action is taken.

-

Definitions:

Effective Tax Rate

The average percentage of net income that a person or corporation pays in taxes, effectively showing the portion of income gone to taxes.

Non-Controlling Interest

A minority share of ownership in a subsidiary that is not directly controlled by the parent company, typically reflected in the equity section of the consolidated financial statement.

Consolidated Financial Position

A representation of a parent company and its subsidiaries' financial status as one entity, summarizing assets, liabilities, and equity.

Acquisition Differential

The difference between the purchase price of a company and the fair value of its identifiable net assets at the acquisition date.

Q7: Which of the following is not a

Q23: Which of the following is typically true

Q29: Compute the cash balance at the end

Q41: Porite Company recognizes revenue in the period

Q42: Adjusting entries are primarily needed for:<br>A) Cash

Q51: Notes payable that are due in two

Q76: Comprehensive income<br>A)Net outflows from peripheral transactions.<br>B)Probable future

Q94: Eve's Apples opened its business on January

Q98: What limitations exist in drawing meaningful comparisons

Q116: Hulkster's 2018 profit margin is (rounded):<br>A)