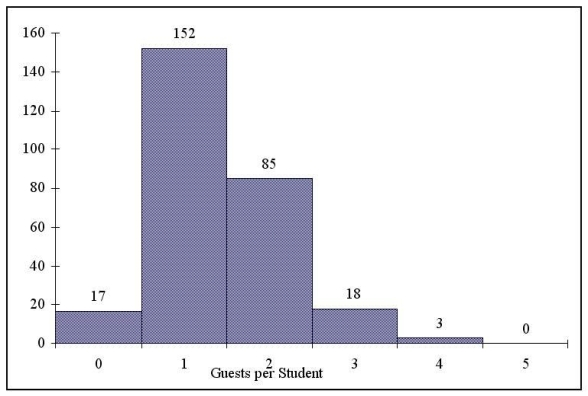

Figure 2.1

Every second semester, the School of Business at a large university coordinates with local business leaders at a luncheon for graduating students, their families, and friends. Corporate sponsorship pays for the lunches of each of the graduating students, but students have to purchase tickets to cover the cost of lunches served to guests they bring with them. The following histogram represents the attendance at the luncheon, where X is the number of guests each graduating student invited to the luncheon and f is the number of graduating students in each category.

-Referring to the histogram from Figure 2.1,how many graduating students attended the luncheon?

Definitions:

Adjusting Entries

Ledger postings concluded during the final phase of an accounting cycle to assign income and costs to their respective periods of occurrence.

Closing Entries

Journal entries made at the end of an accounting period to transfer balances from temporary accounts to permanent accounts.

Adjusted Trial Balance

A compilation of all accounts along with their balances, post-adjustment entries, employed during the creation of financial reports.

Closing Entries

Journal entries made at the end of an accounting period to transfer temporary accounts to permanent accounts and prepare the company's books for the next period.

Q40: Why is it more difficult to make

Q54: Many individuals think that a particular woman

Q64: Referring to Instruction 2-7,the civil suit with

Q82: Referring to Instruction 4-8,what percentage of the

Q96: In left-skewed distributions,which of the following is

Q98: The probability that a particular brand of

Q106: Referring to Instruction 2-2,how many regional offices

Q140: Distinctiveness,consistency,and consensus are three components of the

Q144: Referring to Instruction 3-4B,construct a box-and-whisker plot

Q162: Referring to Instruction 2-14,construct a cumulative percentage