4.2 Supply and Demand Analysis: An Oil Import Fee

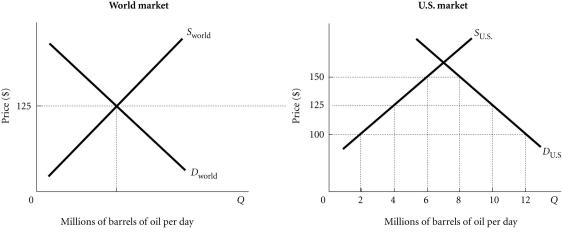

Refer to the information provided in Figure 4.4 below to answer the questions that follow.  Figure 4.4

Figure 4.4

-Refer to Figure 4.4. If the United States levies no taxes on imported oil, which of the following would occur?

Definitions:

Terminating Decimal

A decimal with a limited number of digits following the decimal point.

Decimal Equivalent

The representation of a fraction or percentage as a decimal number.

Percent Equivalent

Percent Equivalent is a way of expressing a number as a fraction of 100, commonly used in calculating interest rates and statistical data.

Terminating Decimal

A decimal number that has a finite number of digits after the decimal point.

Q3: If the quantity of bagels demanded decreases

Q10: In 2006, low-income countries had the highest

Q10: Refer to Figure 5.5. As the price

Q50: Refer to Figure 3.14. An increase in

Q59: Refer to Figure 7.2. The average product

Q64: A decrease in demand for cameras would

Q77: A government wants to reduce electricity consumption

Q93: A simultaneous decrease in both the supply

Q93: Average total cost of producing 100 units

Q94: Suppose a U.S. dollar exchanges for 2