4.2 Supply and Demand Analysis: An Oil Import Fee

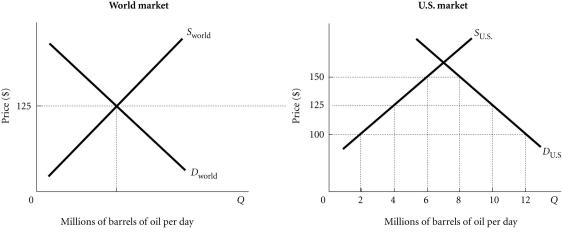

Refer to the information provided in Figure 4.4 below to answer the questions that follow.  Figure 4.4

Figure 4.4

-Refer to Figure 4.4. Assume that initially there is free trade. If the United States then imposes a $25 tax per barrel of imported oil, the tax revenue generated will equal

Definitions:

Direct Labor-Hours

The sum of hours contributed by workers directly participating in the creation of a product or the execution of a service.

Variable Manufacturing Overhead

Costs in manufacturing that vary directly with the level of production output, such as utilities and raw materials.

Fixed Manufacturing Overhead

Costs associated with manufacturing that remain constant regardless of the level of production, such as rent and salaries of managerial staff.

Machine-Hours

A measurement unit used in accounting and manufacturing to allocate costs to products based on the number of hours machines are operated during the production process.

Q8: If the substitution effect of a wage

Q35: Refer to Figure 3.8. Assume there are

Q38: Refer to Figure 6.9. The marginal utility

Q63: Refer to Figure 4.5. Assume that initially

Q93: A simultaneous decrease in both the supply

Q94: Refer to Table 3.2. In this market

Q113: Refer to Figure 6.9. The _ video

Q113: Refer to Table 7.1. If the hourly

Q116: Jane has $500 a week to spend

Q125: Refer to Figure 3.19. When the economy