Refer to the information provided in Figure 16.5 below to answer the questions that follow.

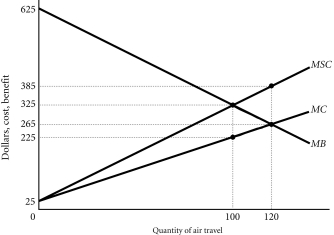

Los Angeles International Airport (LAX) is located next to Playa Del Rey. The noise from air traffic negatively affects individuals living in Playa Del Rey, however, this cost is not considered by airlines or air travelers. The airlines feel they have a right to use the airspace while the individuals living in Playa Del Rey feel they have the right to quiet. The following diagram depicts the marginal costs and marginal benefits associated with air travel.  Figure 16.5

Figure 16.5

-Refer to Figure 16.5. Suppose the government assigns property rights to the airlines, then the airlines and the residents engage in negotiations. The resulting efficient level of air travel is ________.

Definitions:

Johnson Amendment

A U.S. law that prohibits tax-exempt organizations from endorsing or opposing political candidates, to maintain separation of church and state.

President Trump

The 45th President of the United States, Donald J. Trump, who served from January 20, 2017, to January 20, 2021.

501(c)(3)

A section of the U.S. Internal Revenue Code that provides a tax-exempt status to nonprofit organizations that are charitable, religious, educational, scientific, or literary in nature.

501(c)(4) Organizations

Nonprofit groups recognized under the U.S. tax code as "social welfare" organizations, permitted to engage in advocacy and lobbying efforts to a certain extent.

Q19: A command economy is one in which

Q41: The marginal cost of producing 25 units

Q46: Which of the following is an element

Q54: The _ Act extended the government's authority

Q66: The Celler-Kefauver Act of 1950<br>A) declared every

Q82: In well-functioning markets, all of the following

Q85: Second hand cigarette smoke is an example

Q94: Households acquire property through _.<br>A) inheritance only<br>B)

Q128: The labor theory of value states that<br>A)

Q131: The free-rider problem arises<br>A) when people feel