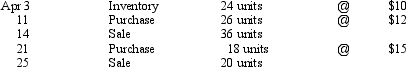

Beginning inventory, purchases and sales data for T-shirts are as follows:

Assuming the business maintains a periodic inventory system, calculate the cost of merchandise sold and ending inventory under the following assumptions:

Assuming the business maintains a periodic inventory system, calculate the cost of merchandise sold and ending inventory under the following assumptions:

a. FIFO

b. LIFO

c. Average cost (round cost of merchandise sold and ending inventory to the nearest dollar)

Definitions:

Qualified Indorsement

An indorsement on a negotiable instrument in which the indorser disclaims any contract liability on the instrument; the notation “without recourse” is commonly used to create a qualified indorsement.

Restrictive

Imposing limitations or conditions on use, action, or movement.

Bearer Instrument

A negotiable financial instrument that is payable to the holder or presenter.

HDC

Stands for Holder in Due Course, a term in commercial law referring to an individual who has acquired a negotiable instrument in good faith and for value, therefore, has certain protections.

Q22: During a bank reconciliation process,<br>A) Outstanding checks

Q35: Fellows Corporation has determined that the $2,700

Q43: Capital and Drawing are reported in the

Q45: The units of Manganese Plus available for

Q48: The post-closing trial balance will generally have

Q74: The amount of deposits in transit is

Q128: When merchandise sold is assumed to be

Q153: Journalize the following merchandise transactions:<br> <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2013/.jpg"

Q157: Generally, the lower the number of days'

Q160: In addition to B2B and B2C transactions,