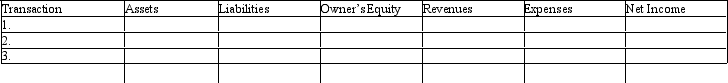

Each of the following transactions for Morrison Company requires an adjusting entry, which if omitted, will overstate or understate assets, liabilities, owner's equity, revenues, expenses, or net income. Indicate the amount and direction of the misstatement that would result if the end of period adjusting entry suggested by the transaction was omitted. Place your results in the table following the transactions and use (+) for overstate, (-) for understate, and (NE) for no effect.

1. Morrison purchased supplies on December 1 for $900. On December 31, $350 of supplies were on hand.

2. Prepaid insurance had a debit balance of $5,400 on December 1, which represented a prepayment for 2 years of insurance.

3. The unearned rent revenue account has a credit balance of $390 on December 1, which represents 3 months rent.

Definitions:

Ration

To distribute or allocate a resource, good, or service in limited amounts, often during shortages or to ensure equitable distribution.

Good

A material item or service that satisfies a human want or need.

Price

The fiscal amount deemed necessary, expected, or expended in purchasing something.

Rationing Device

A method or system used to allocate scarce goods, services, or resources among competing demands.

Q5: The debits and credits from two transactions

Q15: Match each of the following terms with

Q28: The most important output of the accounting

Q51: Office salaries, depreciation of office equipment, and

Q53: The unearned rent account has a balance

Q67: Methods that ignore present value in capital

Q72: Each individual entry in the Revenue Journal

Q137: Which of the following could not be

Q165: If a proposed expenditure of $70,000 for

Q192: Dorman Co. sold merchandise to Smith Co.