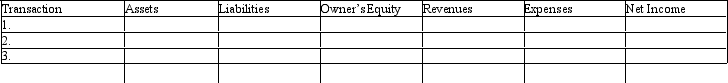

Each of the following transactions for Morrison Company requires an adjusting entry, which if omitted, will overstate or understate assets, liabilities, owner's equity, revenues, expenses, or net income. Indicate the amount and direction of the misstatement that would result if the end of period adjusting entry suggested by the transaction was omitted. Place your results in the table following the transactions and use (+) for overstate, (-) for understate, and (NE) for no effect.

1. Morrison purchased supplies on December 1 for $900. On December 31, $350 of supplies were on hand.

2. Prepaid insurance had a debit balance of $5,400 on December 1, which represented a prepayment for 2 years of insurance.

3. The unearned rent revenue account has a credit balance of $390 on December 1, which represents 3 months rent.

Definitions:

Future

Future refers to the time or period that is to come after the present, often considered in the context of uncertainty or potential.

Recognition

In accounting, recognition refers to the formal recording of an item in the financial statements, acknowledging its existence and the fact that it meets the criteria for financial reporting.

Revenue

Income that a business receives from its normal business activities, usually from the sale of goods and services to customers.

Deferral

A deferral occurs when cash related to a future revenue or expense has been initially recorded as a liability or an asset.

Q7: Computerized systems can be used to capture

Q31: A project has estimated annual net cash

Q56: A project has estimated annual cash flows

Q66: After all of the account balances have

Q66: If the company meets the new target

Q95: Using the Internet to perform business transactions

Q131: A practical approach which is frequently used

Q131: Adjusting entries affect at least one<br>A) income

Q134: Which of the accounting steps in the

Q141: What pricing concept is used if all