Norton Company is considering a project that will require an initial investment of $750,000 and will return $200,000 each year for five years.

Required:

If taxes are ignored and the required rate of return is 9%, what is the project's net present value? Based on this analysis, should Norton Company proceed with the project?

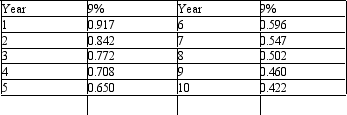

Below is a table for the present value of $1 at compound interest.

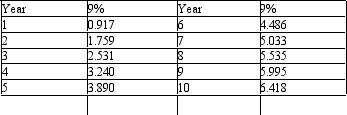

Below is a table for the present value of an annuity of $1 at compound interest.

Below is a table for the present value of an annuity of $1 at compound interest.

Definitions:

Q12: The company determines that the interest expense

Q12: On March 1, a company collects revenue

Q43: Standards are set for only direct labor

Q50: A series of equal cash flows at

Q58: If the adjustment of the unearned rent

Q108: The accounting cycle begins with preparing an

Q116: Assume in analyzing alternative proposals that Proposal

Q131: Assume that Division J has achieved income

Q136: A contra asset account for Land will

Q155: Selected ledger accounts appear below for Fulton