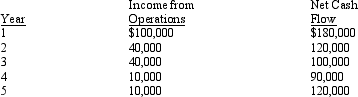

The management of Arkansas Corporation is considering the purchase of a new machine costing $490,000. The company's desired rate of return is 10%. The present value factors for $1 at compound interest of 10% for 1 through 5 years are 0.909, 0.826, 0.751, 0.683, and 0.621, respectively. In addition to the foregoing information, use the following data in determining the acceptability in this situation:  The net present value for this investment is:

The net present value for this investment is:

Definitions:

Low Prices

The condition of goods or services being offered for sale at a reduced or comparatively lower cost.

Low Margins

Refers to a small difference between the cost to produce and sell a product and the price at which it is sold, indicating lower profitability.

Retail Life Cycle

The progression of stages a retail business goes through from introduction to growth, maturity, and decline.

Growth And Decline

Refers to the phases of the business cycle or product life cycle where an entity or product experiences expansion in business activity or market share, and contraction or reduction respectively.

Q5: The debits and credits from two transactions

Q36: Mobile Service Corp. has the following debits

Q46: The balance in the office supplies account

Q56: At the end of the fiscal year,

Q58: If the adjustment of the unearned rent

Q70: A company realizes that the last two

Q77: Businesses that are separated into two or

Q86: A fiscal year<br>A) ordinarily begins on the

Q107: The general term used to indicate delaying

Q152: Mason Corporation had $650,000 in invested assets,