Project A requires an original investment of $65,000. The project will yield cash flows of $15,000 per year for seven years. Project B has a calculated net present value of $5,500 over a five year life. Project A could be sold at the end of five years for a price of $30,000. (a) Using the proper table below determine the net present value of Project A over a five-year life with salvage value assuming a minimum rate of return of 12%. (b) Which project provides the greatest net present value?

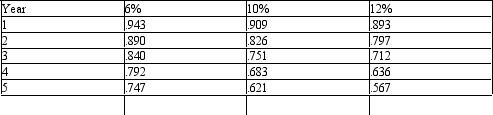

Below is a table for the present value of $1 at compound interest.

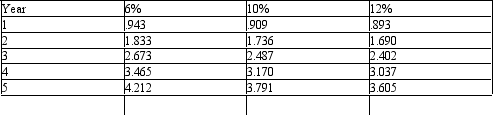

Below is a table for the present value of an annuity of $1 at compound interest.

Below is a table for the present value of an annuity of $1 at compound interest.

Definitions:

Mineral-based Shell

A hard, protective outer layer created by some organisms, composed primarily of minerals.

Flagella

Long, whip-like structures that protrude from the cell body of certain cells, such as bacteria and sperm, used for locomotion.

Photosynthetic

Relating to the process by which green plants and certain other organisms use sunlight to synthesize nutrients from carbon dioxide and water.

Amoebozoans

A group of eukaryotic organisms, mostly comprising amoebas, that move and feed by means of pseudopodia, which are temporary projections of cytoplasm.

Q57: Briefly describe the time value of money.

Q78: A business received an offer from an

Q84: Which is the best example of a

Q102: Hummingbird Company uses the product cost concept

Q105: The profit center income statement should include

Q124: Which of the following expressions is termed

Q143: Budget performance reports prepared for the vice-president

Q149: The objective of transfer pricing is to

Q154: Explain the difference between accrual basis accounting

Q185: ABC Corporation has three service departments with