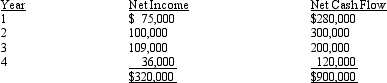

Dickerson Co. is evaluating a project requiring a capital expenditure of $810,000. The project has an estimated life of four years and no salvage value. The estimated net income and net cash flow from the project are as follows:

The company's minimum desired rate of return is 12%. The present value of $1 at compound interest of 12% for 1, 2, 3, and 4 years is .893, .797, .712, and .636, respectively.

The company's minimum desired rate of return is 12%. The present value of $1 at compound interest of 12% for 1, 2, 3, and 4 years is .893, .797, .712, and .636, respectively.

Required:

Determine the net present value.

Definitions:

Formal Education

Structured learning that takes place within academic institutions, leading to recognized qualifications.

Productive Workers

Productive workers are those employees who directly engage in the production of goods or the provision of services, contributing to the output of a business.

Psychic Costs

Non-monetary costs related to emotional stress or mental effort involved in undertaking an activity or making a decision.

Fire Protection Program

encompasses the policies, practices, and tools aimed at preventing, mitigating, and responding to fires.

Q13: Amir Designs purchased a one-year liability insurance

Q14: Which transfer price approach is used when

Q42: Property tax expense for a department store's

Q56: At the end of the fiscal year,

Q76: Morgan Olsen owns and operates Crystal Pool

Q83: At the end of the fiscal year,

Q91: A manager in a cost center also

Q105: The closing process is sometimes referred to

Q132: The Clydesdale Company has sales of $4,500,000.

Q140: The time expected to pass before the