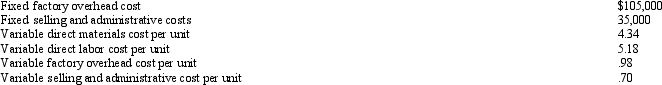

Dotterel Corporation uses the variable cost concept of product pricing. Below is cost information for the production and sale of 35,000 units of its sole product. Dotterel desires a profit equal to a 11.2% rate of return on invested assets of $350,000.  The dollar amount of desired profit from the production and sale of the company's product is:

The dollar amount of desired profit from the production and sale of the company's product is:

Definitions:

Q5: The following revenue and expense account balances

Q65: On April 30, a business estimates depreciation

Q81: The management of Wyoming Corporation is considering

Q81: A budget performance report compares actual results

Q88: Supervisor salaries and indirect factory wages would

Q108: Contractors who sell to government agencies would

Q120: A company is contemplating investing in a

Q138: Pacific Division for Bean Company has a

Q151: Tennessee Corporation is analyzing a capital expenditure

Q161: The adjusting entry to adjust supplies was