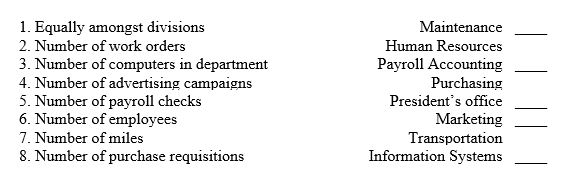

An activity base is used to charge service department expenses. Match each of the following questions with an activity base.

Definitions:

Taxpayer

An individual or entity obligated to pay taxes to a federal, state, or local government.

Deductibility

Refers to the extent to which an expense can be subtracted from gross income to reduce taxable income.

Self-Employed Individuals

People who work for themselves, not as employees of another, and are responsible for their own taxes and benefits.

Deduction Limitations

Restrictions placed on the amount that can be deducted from taxable income, often varying by the type of deduction and the taxpayer's income level.

Q2: If there is a balance in the

Q59: The responsibility for coordinating the preparation of

Q65: The standard costs and actual costs for

Q91: Mallard Corporation uses the product cost concept

Q111: Materials used by Best Bread Company in

Q128: Principle of exceptions allows managers to focus

Q134: When budget goals are set too tight,

Q147: Nuthatch Corporation began its operations on September

Q153: The following financial information was summarized from

Q162: For February, sales revenue is $700,000; sales