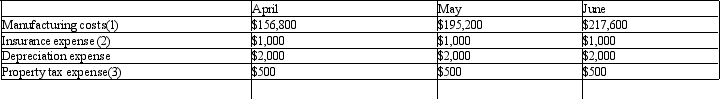

Finch Company began its operations on March 31 of the current year. Finch Co. has the following projected costs:  (1) 3/4 of the manufacturing costs are paid for in the month they are incurred. 1/4 is paid in the following month.

(1) 3/4 of the manufacturing costs are paid for in the month they are incurred. 1/4 is paid in the following month.

(2) Insurance expense is $1,000 a month, however, the insurance is paid four times yearly in the first month of the quarter, i.e. January, April, July, and October.

(3) Property tax is paid once a year in November.

The cash payments for Finch Company in the month of May are:

Definitions:

Bond Premium

The amount by which the market price of a bond exceeds its par value, typically arising when the bond's interest rate is higher than the market rate.

Forward Contract

A customized financial agreement to buy or sell an asset at a specified future date at a price agreed upon today.

Future Date

A specified day in the future, often used in the context of agreements or financial transactions that will occur at a later time.

Amortized Historical Cost

The accounting method of gradually writing off the initial cost of an asset over a period, adjusting for depreciation or amortization.

Q1: What is the term used to describe

Q6: Match the following terms with their definitions.

Q14: In order to choose the proper activity

Q53: The chart of accounts should be the

Q67: Which of the following statements is true

Q73: Mocha Company manufactures a single product by

Q73: Given the following cost data, what type

Q158: A responsibility center in which the department

Q170: In a process costing system, each process

Q182: For the current year ending April 30,