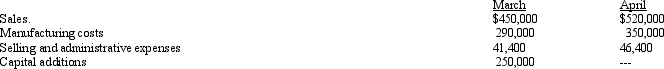

The treasurer of Systems Company has accumulated the following budget information for the first two months of the coming year:

The company expects to sell about 35% of its merchandise for cash. Of sales on account, 80% are expected to be collected in full in the month of the sale and the remainder in the month following the sale. One-fourth of the manufacturing costs are expected to be paid in the month in which they are incurred and the other three-fourths in the following month. Depreciation, insurance, and property taxes represent $6,400 of the probable monthly selling and administrative expenses. Insurance is paid in February and a $40,000 installment on income taxes is expected to be paid in April. Of the remainder of the selling and administrative expenses, one-half are expected to be paid in the month in which they are incurred and the balance in the following month. Capital additions of $250,000 are expected to be paid in March.

The company expects to sell about 35% of its merchandise for cash. Of sales on account, 80% are expected to be collected in full in the month of the sale and the remainder in the month following the sale. One-fourth of the manufacturing costs are expected to be paid in the month in which they are incurred and the other three-fourths in the following month. Depreciation, insurance, and property taxes represent $6,400 of the probable monthly selling and administrative expenses. Insurance is paid in February and a $40,000 installment on income taxes is expected to be paid in April. Of the remainder of the selling and administrative expenses, one-half are expected to be paid in the month in which they are incurred and the balance in the following month. Capital additions of $250,000 are expected to be paid in March.

Current assets as of March 1 are composed of cash of $45,000 and accounts receivable of $51,000. Current liabilities as of March 1 are composed of accounts payable of $121,500 ($102,000 for materials purchases and $19,500 for operating expenses). Management desires to maintain a minimum cash balance of $20,000.

Prepare a monthly cash budget for March and April.

Definitions:

Line Power Supply

The primary source of electrical energy for a system, typically connected directly to utility service lines.

PLC Programs

Sequences of instructions written for a programmable logic controller (PLC) to direct the operation of machinery or processes.

Flash EEPROM

A type of non-volatile memory chip that can be electronically erased and reprogrammed, commonly used for storing firmware or settings that might need to be updated.

EEPROM

EEPROM, or Electrically Erasable Programmable Read-Only Memory, is a type of non-volatile memory used in computers and other devices to store small amounts of data that must be saved when power is removed.

Q18: The operating budgets of a company include:<br>A)

Q32: A proof of the equality of debits

Q99: Which of the following budgets provides the

Q103: Job order manufacturing and process manufacturing are

Q112: Match the following terms with their definitions.<br>

Q126: Louis Company sells a single product at

Q147: The inventory at April 1, 2012, and

Q152: The Lucy Corporation purchased and used 129,000

Q160: Forde Co. has an operating leverage of

Q192: Consuming goods and services in the process