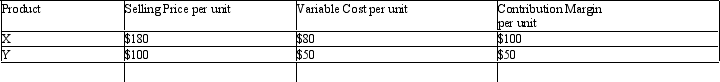

Steven Company has fixed costs of $160,000. The unit selling price, variable cost per unit, and contribution margin per unit for the company's two products are provided below.

The sales mix for product X and Y is 60% and 40% respectively. Determine the break-even point in units of X and Y.

The sales mix for product X and Y is 60% and 40% respectively. Determine the break-even point in units of X and Y.

Definitions:

Variable Costs

Expenses that fluctuate in direct proportion to the quantity of output or sales, including items like labor and materials.

Sensitivity Analysis

A method employed to ascertain the effects of varying an independent variable on a specific dependent variable, given certain presuppositions.

Fixed Costs

Expenses that remain unchanged regardless of the amount of goods produced or sold, staying fixed amidst variations in business operations.

Sensitivity Analysis

is a technique used to determine how different values of an independent variable will affect a particular dependent variable under a given set of assumptions.

Q36: Favorable volume variances may be harmful when:<br>A)

Q56: Which of the following is not a

Q60: One of the differences in accounting for

Q74: Standard costs are determined by multiplying expected

Q91: The following data relate to direct labor

Q98: Big Wheel, Inc. collects 25% of its

Q98: Discuss how equivalent units are computed under

Q117: Proof that the dollar amount of the

Q148: Magnolia, Inc. manufactures bedding sets. The budgeted

Q204: The normal balance of the drawing account