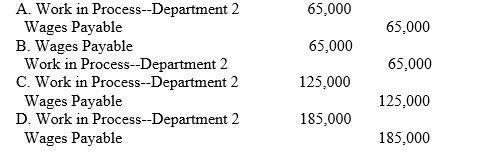

Mocha Company manufactures a single product by a continuous process, involving three production departments. The records indicate that direct materials, direct labor, and applied factory overhead for Department 1 were $100,000, $125,000, and $150,000, respectively. The records further indicate that direct materials, direct labor, and applied factory overhead for Department 2 were $55,000, $65,000, and $80,000, respectively. In addition, work in process at the beginning of the period for Department 1 totaled $75,000, and work in process at the end of the period totaled $60,000. The journal entry to record the flow of costs into Department 2 during the period for direct labor is:

Definitions:

Valuation Allowance

A reserve created against the deferred tax asset due to uncertainty concerning its realization.

Unrealized Gain

Profit that comes from an investment that has increased in value but has not yet been sold by the investor, thus not resulting in actual income.

Trading Investments

Assets purchased with the intention of reselling in the short term for profit, often including stocks and bonds.

Equity Investment Transactions

Financial activities involving the buying and selling of stock or ownership shares in a company, impacting shareholder equity.

Q3: The recording of the factory labor incurred

Q5: Equivalent production units, usually are determined for<br>A)

Q21: The following production data were taken from

Q76: Copper Hill Inc. manufactures laser printers within

Q91: Callon Industries has projected sales of 67,000

Q118: Department E had 4,000 units in Work

Q159: Knowing how costs behave is useful to

Q163: Costs are transferred, along with the units,

Q166: If the cost of employee wages is

Q199: Cost behavior refers to the manner in