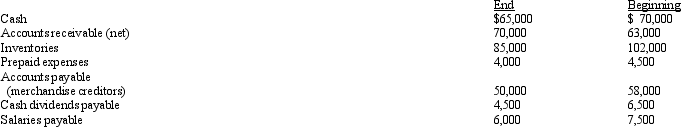

The net income reported on an income statement for the current year was $58,000. Depreciation recorded on fixed assets for the year was $24,000. In addition, equipment with an original cost of $130,000 and accumulated depreciation of $115,000 on the date of the sale, was sold for $20,000. Balances of the current asset and current liability accounts at the end and beginning of the year are listed below. Prepare the cash flows from operating activities section of a statement of cash flows using the indirect method.

Definitions:

Taxable Income

The amount of an individual's or corporation's income used to determine how much tax is owed to the government.

Marginal Tax Rate

The percentage of tax applied to your income for every tax bracket in which you qualify.

Average Tax Rate

The fraction of an individual's total income that is paid in taxes, calculated by dividing the total taxes paid by total income.

Taxable Income

the amount of income used to determine how much tax an individual or a company owes to the government, after deductions and exemptions.

Q44: Cash flows from investing activities, as part

Q62: For each of the following, identify whether

Q67: If accounts payable have increased during a

Q83: Rarely would the cash flows from operating

Q84: A company sells goods for $150,000 that

Q91: Which of the following is an example

Q113: Blanton Corporation purchased 35% of the outstanding

Q153: A partnership is subject to federal income

Q156: Short-term creditors are typically most interested in

Q166: Sinking Fund Investments would be classified on