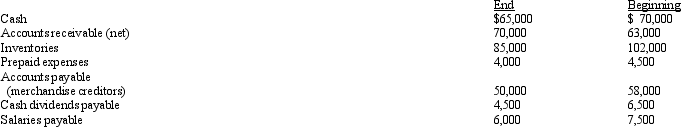

The net income reported on an income statement for the current year was $58,000. Depreciation recorded on fixed assets for the year was $24,000. In addition, equipment with an original cost of $130,000 and accumulated depreciation of $115,000 on the date of the sale, was sold for $20,000. Balances of the current asset and current liability accounts at the end and beginning of the year are listed below. Prepare the cash flows from operating activities section of a statement of cash flows using the indirect method.

Definitions:

Expected Growth Rate

The projected annual rate at which an investment or business is expected to grow.

Equilibrium

A state in which market supply and demand balance each other, resulting in stable prices.

Semistrong Efficient

A term from the Efficient Market Hypothesis indicating that all public information is reflected in stock prices, along with all historical data.

SML

The Security Market Line, a graphical representation of the capital asset pricing model (CAPM), showing the expected return of investments as a function of their beta or systemic risk.

Q8: An analysis of the general ledger accounts

Q9: The following information is available for Carter

Q19: Under the cost method, when treasury stock

Q27: On the basis of the following data

Q38: On January 1, 2014, Gemstone Company obtained

Q74: A company reports the following:<br> <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2013/.jpg"

Q75: Planning is the process of developing the

Q91: Cash flows from investing activities, as part

Q94: When long-term investments in bonds are sold

Q107: The account Valuation Allowance for Trading Securities