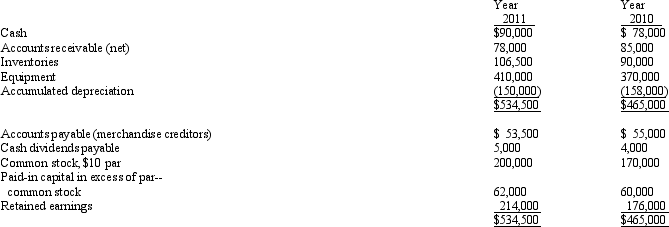

On the basis of the following data for Grant Co. for 2011 and the preceding year ended December 31, 2010, prepare a statement of cash flows. Use the indirect method of reporting cash flows from operating activities. Assume that equipment costing $125,000 was purchased for cash and equipment costing $85,000 with accumulated depreciation of $65,000 was sold for $15,000; that the stock was issued for cash; and that the only entries in the retained earnings account were net income of $56,000 and cash dividends declared of $18,000.

Definitions:

PV Of CCA Tax Shield

The present value of the reduction in taxes payable by a firm due to the depreciation expenses claimed on its capital assets.

PV Of After-Tax Lease Payments

The present value of lease payments after accounting for taxes, used to evaluate the financial cost or benefit of leasing.

Original Investment

The initial amount of money put into a project, asset, or venture.

Sales And Leaseback Arrangement

A financial transaction where one sells an asset and leases it back for the long-term; thus, one continues to use the asset but no longer owns it.

Q33: When the corporation issuing the bonds has

Q60: Merritt Company acquired a building valued at

Q73: What is a major advantage of using

Q82: A corporation has 50,000 shares of $25

Q87: The balance in Retained Earnings at the

Q107: Bonds with a face amount $1,000,000, are

Q119: Cash dividends of $50,000 were declared during

Q135: To arrive at cash flows from operations,

Q149: The present value of $5,000 to be

Q154: What term is used to describe the