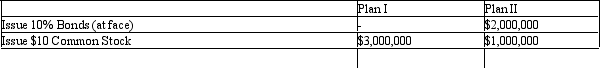

Jenson Co., is considering the following alternative plans for financing their company:

Income tax is estimated at 40% of income.

Income tax is estimated at 40% of income.

Determine the earnings per share of common stock under the two alternative financing plans, assuming income before bond interest and income tax is $1,000,000.

Definitions:

Value

Under the Code (except for negotiable instruments and bank collections), generally any consideration sufficient to support a simple contract.

Qualified Indorsement

An endorsement on a negotiable instrument that limits the liability of the endorser or specifies particular conditions for the endorsement's validity.

Liability

A legal responsibility or obligation, often involving financial compensation, that arises from actions or agreements.

Payable to Cash

A term indicating that a check or draft is to be paid to the bearer or holder, making it easily transferable.

Q9: If cash dividends of $135,000 were paid

Q10: When a partner withdraws from the partnership

Q24: Sorenson Co., is considering the following alternative

Q31: Bonds Payable has a balance of $1,000,000

Q31: Selected data for the current year ended

Q85: Federal unemployment taxes are paid by the

Q104: On the first day of the current

Q111: A corporation issues $100,000, 10%, 5-year bonds

Q142: Jackson and Campbell have capital balances of

Q158: Top Notch, LLC provides repair services for