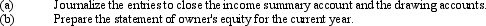

Sharp and Townson had capital balances of $60,000 and $120,000 respectively on January 1 of the current year. On May 8, Sharp invested an additional $10,000 in the partnership. During the year, Sharp and Townson withdrew $25,000 and $45,000 respectively. After closing all expense and revenue accounts at the end of the year, Income Summary has a credit balance of $90,000, that Sharp and Townson have agreed to split on a 2:1 basis, respectively.

Definitions:

Constructing Airplane

The engineering and assembling processes involved in building aircraft.

Certain Date

A specific, identified day in the calendar on which an event is scheduled to take place or a deadline is set.

Waste Product

Any unwanted or unusable material produced during a manufacturing process, which is often discarded or recycled.

Factory Setting

An industrial environment equipped for manufacturing goods, including facilities such as production lines and machinery.

Q3: An intangible asset is one that has

Q27: Cash dividends become a liability to a

Q50: For paying their payroll, most employers use

Q54: The effective interest method produces a constant

Q59: Prepare entries to record the following:<br> <img

Q65: The Weber Company purchased a mining site

Q74: Zero-coupon bonds do provide for interest payments.

Q142: For income tax purposes most companies use

Q174: When a new partner is admitted by

Q181: If $1,000,000 of 8% bonds are issued