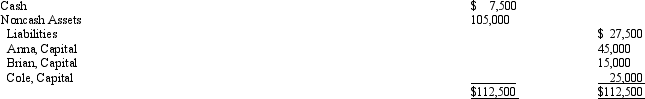

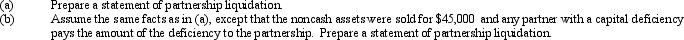

After discontinuing the ordinary business operations and closing the accounts on May 7, the ledger of the partnership of Anna, Brian, and Cole indicated the following:

The partners share net income and losses in the ratio of 3:2:1. Between May 7-30, the noncash assets were sold for $150,000, the liabilities were paid, and the remaining cash was distributed to the partners.

The partners share net income and losses in the ratio of 3:2:1. Between May 7-30, the noncash assets were sold for $150,000, the liabilities were paid, and the remaining cash was distributed to the partners.

Definitions:

Relaxation Techniques

Methods or practices used to reduce stress and anxiety, including activities like meditation, deep-breathing exercises, and progressive muscle relaxation.

Fatigue-Producing Activities

Tasks or actions that result in a significant decrease in energy or increased tiredness.

Short Sleeper

An individual who requires significantly less sleep than the average person, often without experiencing negative effects.

Zolpidem

A medication primarily used for the short-term treatment of sleeping problems.

Q7: Taxes deducted from an employee's earnings to

Q11: Which statement below is not a reason

Q62: Capital expenditures are costs of acquiring, constructing,

Q69: The following totals for the month of

Q71: A company with 100,000 authorized shares of

Q91: Quick assets include<br>A) cash; cash equivalents, receivables,

Q99: When the market rate of interest was

Q131: Residual value is also known as all

Q140: Xavier and Yolanda have original investments of

Q170: If total assets decreased by $30,000 during