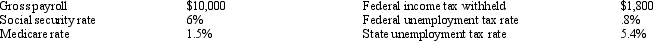

Use the following information to answer the following questions. Assuming no employees are subject to ceilings for their earnings, Jensen Company has the following information for the pay period of January 15 - 31, 20xx. Assuming that all wages are subject to federal and state unemployment taxes, the Payroll Taxes Expense would be recorded as:

Assuming that all wages are subject to federal and state unemployment taxes, the Payroll Taxes Expense would be recorded as:

Definitions:

Psychiatric Disorders

Mental health conditions characterized by changes in emotion, thinking or behavior (or a combination of these) associated with distress and/or impaired functioning.

ADHD

Attention Deficit Hyperactivity Disorder, a neurodevelopmental disorder characterized by inattention, hyperactivity, and impulsivity.

Anxiety

A mental health disorder characterized by feelings of worry, anxiety, or fear that are strong enough to interfere with one's daily activities.

ODD

Oppositional Defiant Disorder, a behavioral disorder in children characterized by a consistent pattern of angry, defiant, and vindictive behavior towards authority figures.

Q21: In admitting a new partner, where the

Q22: Contingent pay CP)plans reward individuals based on

Q25: The journal entry a company uses to

Q33: The issuance of common stock affects both

Q65: Kala and Leah, partners in Best Designs,

Q67: Sabas Company has 20,000 shares of $100

Q78: Abby and Bailey are partners who share

Q113: Which of the following is not a

Q146: FICA tax is a payroll tax that

Q163: Which of the following forms is typically