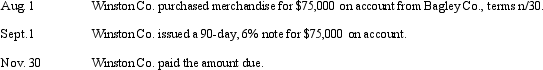

Journalize the following entries on the books of Winston Co. for August 1, September 1, and November 30. (Assume a 360-day year is used for interest calculations.)

Definitions:

Federal Income Tax

A tax levied by the federal government on the annual earnings of individuals, corporations, trusts, and other legal entities.

Ability-To-Pay Principle

A taxation principle that suggests taxes should be levied according to an individual's or entity's ability to pay, favoring a more equitable distribution of the tax burden.

U.S. Income Tax

A tax imposed by the U.S. government on the income generated by businesses and individuals within its jurisdiction.

FICA Tax

A federal payroll tax in the United States that funds Social Security and Medicare programs.

Q22: Within the United States, the dominant body

Q33: Which one of the following traits is

Q41: The total assets and the total liabilities

Q42: Project teams are considered teams that are

Q59: For which of the following taxes is

Q70: Jonathan Martin is the owner and operator

Q97: Assuming no employees are subject to ceilings

Q103: Equipment purchased at the beginning of the

Q160: The authorized stock of a corporation<br>A) must

Q179: Carla and Eliza share income equally. During