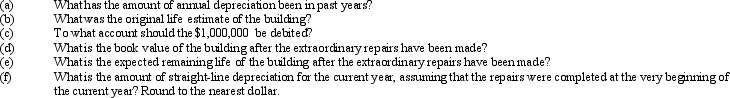

A number of major structural repairs completed at the beginning of the current fiscal year at a cost of $1,000,000 are expected to extend the life of a building 10 years beyond the original estimate. The original cost of the building was $6,552,000, and it has been depreciated by the straight-line method for 25 years. Estimated residual value is negligible and has been ignored. The related accumulated depreciation account after the depreciation adjustment at the end of the preceding fiscal year is $4,550,000.

Definitions:

Owner Personality

The unique set of personal traits and characteristics of a business owner that influences their decisions and leadership style.

Personal Branding

The practice of marketing oneself and one's career as a brand, highlighting unique skills, values, and experiences.

Company's Success

Refers to the achievement of a company's goals and objectives, leading to its growth, profitability, and long-term sustainability.

Promotion

Marketing efforts aimed at increasing awareness of a product or service to boost sales and enhance brand visibility.

Q5: Tomas and Saturn are partners who share

Q17: Interest expense is reported in the operating

Q40: In a partnership liquidation, gains and losses

Q41: Discuss the characteristics of a legally sound

Q47: What is a feedback gap?<br>A)When employees want

Q51: All six appraisal meetings should be held

Q84: Indicate whether each of the following represents

Q90: On July 8, Alton Co. issued an

Q144: The balance sheet of Morgan and Rockwell

Q163: Xavier and Yolanda have original investments of