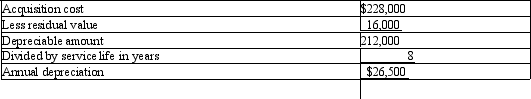

On July 1st, Harding Construction purchases a bulldozer for $228,000. The equipment has a 8 year life with a residual value of $16,000. Harding uses straight-line depreciation.

(a) Calculate the depreciation expense and provide the journal entry for the first year ending December 31st.

(b) Calculate the third year's depreciation expense and provide the journal entry for the third year ending December 31st.

(c) Calculate the last year's depreciation expense and provide the journal entry for the last year.

Annual depreciation is:

Definitions:

Old Routines

Established habits or ways of doing things that are often resistant to change.

Role Patterns

Refers to the typical behaviors, responsibilities, and expectations associated with particular positions or roles within an organization or social setting.

Change Management

The discipline that guides how to prepare, equip, and support individuals to successfully adopt change in order to drive organizational success and outcomes.

Refreezing

Represents the final stage in Lewin's change management model where new behaviors or changes are solidified into the organizational culture after a change process.

Q25: One of several reasons a CP plan

Q32: Critically assess how an organization should decide

Q34: When selecting a group to pilot test

Q54: During the formal performance review meeting the

Q61: A fixed asset with a cost of

Q70: An aid in internal control over payrolls

Q79: Carmen Flores' weekly gross earnings for the

Q81: Franco and Elisa share income equally. During

Q138: The journal entry a company uses to

Q182: An advantage of the partnership form of