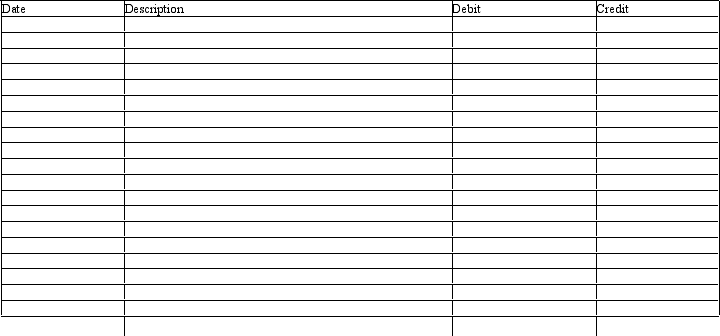

Clanton Company engaged in the following transactions during 2011. Record each in the general journal below:

1) On January 3, 2011, Clanton purchased a copyright from Dalton Company with a cost of $250,000 with a remaining useful life of 25 years.

2) On January 10, 2011, Clanton purchased a trademark from Felton Company with a cost of $700,000.

3) On July 1, 2011, Clanton purchased a patent from Garrison Company at a cost of $80,000. The remaining legal life of the patent is 15 years and the expected useful life is 11 years.

4) On July 2, 2011, Clanton paid $30,000 in legal fees to defend the patent protection purchased on July 1, 2011.

5) Recorded the appropriate amortization for the intangible assets for 2011.

6) Clanton Company includes an asset in its ledger recorded when Clanton purchased a computer service business at a price in excess of the fair value of the assets of the company in the amount of $400,000. At December 31, 2011, $100,000 of this asset has become impaired.

Definitions:

Equivalent Unit

A concept used in cost accounting to convert partially completed units into a number of fully completed units.

Mixing Department

A specialized production department where raw materials are combined or mixed to create a product or substance.

FIFO Method

First-In, First-Out method; an inventory valuation method where goods first purchased or produced are the first to be sold, used in accounting to calculate the cost of goods sold and ending inventory.

Ending Work

Also known as ending work in process, it refers to the value of goods still in production at the end of an accounting period.

Q18: Obligations that depend on past events and

Q27: A building with an appraisal value of

Q34: Your organization is considering implementing a team

Q39: Douglas pays Selena $45,000 for her 30%

Q43: Expenses are assets that are used up

Q81: Franco and Elisa share income equally. During

Q90: When a company establishes an outstanding reputation

Q103: On June 8, Alton Co. issued an

Q157: In a defined benefits plan, the employer

Q173: Krammer Company has liabilities equal to one