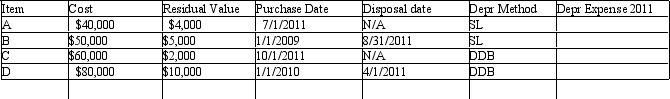

For each of the following fixed assets, determine the depreciation expense and the book value for the dates requested:

Disposal date is N/A if asset is still in use.

Method: SL = Straight Line; DDB = Double Declining Balance

Assume the estimated life was 5 years for each asset.

Definitions:

Machine-Hours

A unit of measurement for tracking the operational time of machines, crucial in determining efficiency and production costs in manufacturing settings.

Overhead Rate

A calculation used in cost accounting to allocate indirect costs to products or services, typically expressed as a percentage or rate per unit of activity.

Predetermined Overhead Rate

A rate used to apply manufacturing overhead to products or job orders, calculated in advance based on estimated costs and activity levels.

Machine-Hours

A measure of the amount of time a machine is operated, often used as a basis for allocating manufacturing overhead costs in job-order and process costing systems.

Q4: The statement of cash flows consists of

Q14: Teams are used as a possible way

Q20: When a partnership dissolves, a new partnership

Q27: Discuss the advantages of implementing a performance

Q29: The role of accounting is to provide

Q45: Organizations often do a poor job of

Q72: If a fixed asset with a book

Q96: Prior to liquidating their partnership, Craig and

Q97: When a seller allows a buyer an

Q153: Which of the following would be used