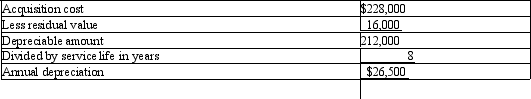

On July 1st, Harding Construction purchases a bulldozer for $228,000. The equipment has a 8 year life with a residual value of $16,000. Harding uses straight-line depreciation.

(a) Calculate the depreciation expense and provide the journal entry for the first year ending December 31st.

(b) Calculate the third year's depreciation expense and provide the journal entry for the third year ending December 31st.

(c) Calculate the last year's depreciation expense and provide the journal entry for the last year.

Annual depreciation is:

Definitions:

Distinct Groups

Groups characterized by clear, definable differences or boundaries in social, economic, demographic, or other relevant aspects.

Southwest Airlines

This is an American low-cost carrier known for its unique business model and customer service approach.

Passenger Traffic

The movement of passengers via modes of transportation such as air, sea, or land.

Inelastic Demand

Characterizes a situation where the quantity demanded of a good or service changes very little in response to changes in price.

Q19: What is the goal of feedback?<br>A)To improve

Q21: Which of the following is a motivation

Q25: The cost of repairing damage to a

Q26: What are the defining characteristics of a

Q42: Project teams are considered teams that are

Q45: The main objective for all business is

Q54: For each of the following companies, identify

Q63: All of the following are general-purpose financial

Q69: The cost of replacing an engine in

Q98: Partnership's asset accounts should be changed from