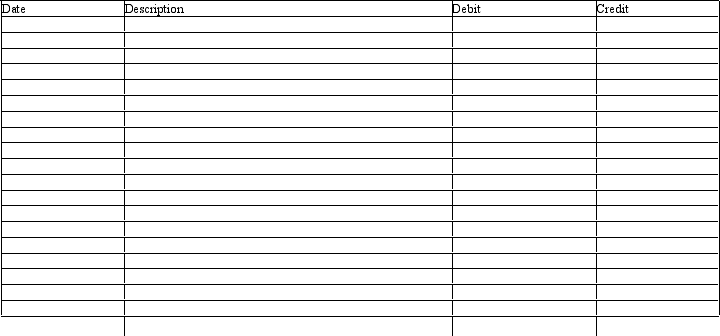

Clanton Company engaged in the following transactions during 2011. Record each in the general journal below:

1) On January 3, 2011, Clanton purchased a copyright from Dalton Company with a cost of $250,000 with a remaining useful life of 25 years.

2) On January 10, 2011, Clanton purchased a trademark from Felton Company with a cost of $700,000.

3) On July 1, 2011, Clanton purchased a patent from Garrison Company at a cost of $80,000. The remaining legal life of the patent is 15 years and the expected useful life is 11 years.

4) On July 2, 2011, Clanton paid $30,000 in legal fees to defend the patent protection purchased on July 1, 2011.

5) Recorded the appropriate amortization for the intangible assets for 2011.

6) Clanton Company includes an asset in its ledger recorded when Clanton purchased a computer service business at a price in excess of the fair value of the assets of the company in the amount of $400,000. At December 31, 2011, $100,000 of this asset has become impaired.

Definitions:

Securities

Financial instruments representing ownership (stocks), a creditor relationship with a government or corporation (bonds), or other rights to ownership or profit.

Open Market

A marketplace that is open to all participants, where buyers and sellers engage in trade without significant restrictions or regulations.

Interest Rates

The percentage of a sum of money charged for its use, often expressed annually.

Excess Reserves

The amount of reserves that a bank holds beyond the required minimum set by the central bank or regulatory authority.

Q28: Allen Marks is the sole owner and

Q47: Regardless of who rates performance,the rater is

Q48: Immediately prior to the admission of Allen,

Q55: A current liability is a debt that

Q64: The formula for depreciable cost is<br>A) initial

Q83: Federal unemployment compensation taxes that are collected

Q96: Which of the following is the most

Q109: Countries outside the U.S. use financial accounting

Q148: Both the initial cost of the asset

Q165: The amount of depreciation expense for the