Refer to the Financial Statements for Wal*Mart, Below

Wal"Mart (in millions) | Consolidated Statements of Operations Fiscal Year Ended | ||||||

| 31-Jan X2 | 31-Jan X3 | 31-Jan X4 | 31-Jan X5 | 31-Jan X6 | 31-Jan X7 | 31-Jan X8 | |

| Net sales | $ 43,887 | $ 55,484 | $ 67,345 | $ 82,494 | $ 93,627 | $ 104,859 | |

| Rentals from licensed dept | 28 | 36 | 47 | ||||

| Other income-net | 374 | 465 | 593 | 918 | 1,122 | 1,287 | |

| Total revenues | 44,289 | 55,985 | 67,985 | 83,412 | 94,749 | 106,146 | 118,884 |

| Cost of sales | 34,786 | 44,174 | 53,444 | 65,586 | 74,564 | 83,663 | |

| Operating, Selling, General& Administrative Expenses | 6,684 | 8,321 | 10,333 | 12,858 | 14,951 | 16,788 | |

| Total operating expenses | 41,470 | 52,495 | 63,777 | 78,444 | 89,515 | 100,451 | |

| Operating income | 2,819 | 3,490 | 4,208 | 4,968 | 5,234 | 5,695 | 6,378 |

| Interest costs | |||||||

| Debt | 113 | 143 | 331 | 520 | 692 | 629 | |

| Capital leases | 153 | 180 | 186 | 186 | 196 | 216 | |

| 266 | 323 | 517 | 706 | 888 | 845 | 930 | |

| Income before taxes | 2,553 | 3,167 | 3,691 | 4,262 | 4,346 | 4,850 | 5,449 |

| Income tax expense | |||||||

| Current | 906 | 1,137 | 1,325 | 1,572 | 1,530 | 1,974 | |

| Deferred | 39 | 35 | 33 | 9 | 76 | (180) | |

| 945 | 1,172 | 1,358 | 1,581 | 1,606 | 1,794 | 2,016 | |

| Net income | $ 1,608 | $ 1,995 | $ 2,333 | $ 2,681 | $ 2,740 | $ 3,056 | $ 3,433 |

| EPS | $ 0.70 | $ 0.87 | $ 1.02 | $ 1.17 | $ 1.19 | $ 1.33 | |

| Dividends per share (for the whole year) | $ 0.09 | $ 0.11 | $ 0.13 | $ 0.17 | $ 0.20 | $ 0.21 | |

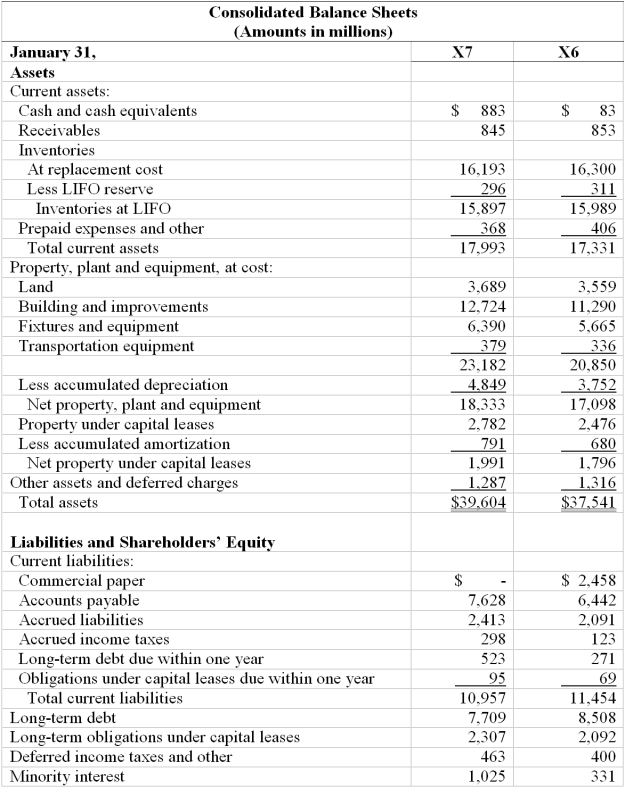

a. Calculate for X7 the ratios listed below. X6 numbers are provided for comparative purposes.

b. Working capital management is an important consideration for many companies. Which component of Wal*Mart's working capital do you think it spends most time managing? That is, which component is likely to be the most important? Why? What has happened to this component from X6 to X7?

Definitions:

Decision-making

The process of selecting among various options or courses of action.

Rational model

A decision-making strategy that relies on logical and systematic analysis of available information and alternatives to achieve the best possible outcome.

Analytical fashion

A method or manner that involves understanding complex issues by breaking them down into simpler components for analysis.

Scientific thinking

Involves using systematic, evidence-based methods and critical analysis to solve problems and make decisions.

Q4: The sub-discipline of labor economics deals with:<br>A)

Q13: Go to the official MLB website (http://www.mlb.com)

Q14: When Mark Lemke said that Greg Maddux

Q14: The cash flow from operations and cash

Q17: ROE is defined as net income divided

Q22: Return on equity is the return stockholders

Q34: Treasury stock is:<br>A) investments in government securities.<br>B)

Q43: When calculating Acme's return on net operating

Q46: If future expected return on common stockholders'

Q73: Minority interest appears on the balance sheet